Philippine Defense Today (Adroth.ph)

In Defense of the Republic of the PhilippinesCould self-reliance save AFP modernization under Duterte?

Wednesday , 22, June 2016 AFP modernization, Self-Reliant Defense Posture Leave a commentThe Aquino administration’s Presidential candidate, Mar Roxas, had campaigned on a promise of continuing with the courses of action of the outgoing administration and represented continuity of an AFP Modernization Program that achieved gains hitherto unseen:

| Aquino administration | Arroyo administration | Ramos administration | ||

| 2015 | 2007 to 2011 | The Plan: 1995 |

But with the victory of President-elect Rudrigo Duterte, a self-described socialist whose campaign platform centered on an inward-focused good governance campaign, declarations of doom about the AFP Modernization Program swept across the defense-centric social media landscape. The perceived outlook for modernization, particularly for acquisitions that were either still planned or ongoing was bleak.

Further aggravating the concerns of the defense-enthusiast community were his controversial statements with regard to US and Australian relations and his openness to bilateral talks with China regarding the West Philippine Sea and an open aversion to war with the red dragon that had been gobbling up Philippine territory in its western approaches. To many, the nightmare scenario had arrived.

Stigma around implements of war

Given Duterte’s preference to avoid conflict, and announced repertoire of populist programs that benefit the poor, defense planners have reason to worry about the still-unallocated billions of pesos required for ongoing and upcoming programs:

- Ten of the 12 FA-50PH Surface Attack Aircraft / Lead-In Fighter Trainers remain in the queue for delivery

- The Long-Range Patrol Aircraft has not yet even reached the bid invitation phase

- The Close-Air Support project remains in bid-supplement limbo

- The second Tarlac class Strategic Sealift Vessel (SSV) remains under construction

- Two multi-purpose Frigates are still in the post qualification phase and are ripe for cancellation

- Three Multi-Purpose Attack Craft (MPAC) Mk.3 whose design is still being finalized

While the Philippine Navy has been careful to couch the SSV project as a dual-purpose asset that will prove useful in the event of another Yolanda crisis as well as for evacuating Filipino OFWs in crisis zones like the Middle East — in addition to its obvious amphibious assault function — the other projects listed above lack this protection. All are clearly implements of war . . . a war that Duterte appears hell-bent on avoiding.

Highlighting the value of building up a credible defense capability is a given. For a mayor a major city, security as an enabler of progress should be a fairly well understood concept. Especially for one that oversaw a city that had its share of security crisises over the past decades. Your constituents can’t earn a living if they aren’t safe.

External defense, however, would arguably be an unfamiliar rendition of an old tune. The enemy in this case is different, and enjoys an overmatch that is simply beyond whatever resources the Philippines could ever hope to muster on its own. Our current, and foreseeable, defense posture only makes sense when done in concert with our allies — allies with whom Duterte’s campaign rhetoric raised concerns. How such relationships play out over the next six years are hard to predict.

Defense planners need a ready answer for the question: “Would spending for external defense just be throwing money away?”

Among the plethora of reasonable answers to the questions above, one tack that the DND-AFP would do well to consider would be to highlight the opportunities these assets represent to the domestic economy. Benefits that would be available for both existing commercial offerings as well as potential future endeavors between the original manufacturer of the equipment and Philippine companies.

If the DND-AFP is able to demonstrate a reasonable, direct, return on investment for the Philippine economy, then the billions spent would be even more of an investment for national growth than the argument that defense is an enabler for economic prosperity. If the defense establishment can emphasize how these acquisitions put food on the table of Filipino workers, then these acquisitions will fit well with the President-elect’s campaign focus on business opportunities. The local military industrial complex could very well be what saves the AFP modernization program.

The next two sections of this article will present concrete examples of opportunities that map to the list of projects, presented earlier, that could be at risk in the event of a budget crunch:

- Economic windfall from aircraft aquisitions

- Economic windfall from maritime acquisitions

Economic windfall from aircraft acquisitions

As of writing, the Philippines lacks any serious indigenous aeronautical endeavors. The dreams offered by the XL-14 Maya and XL-15 Tagak in the 50s, and even the Cali Pinto of the Marcos years have been relegated to the realm of the “what-if” with no clear-cut path to the here and now.

|

|

|

| XL-15 Tagak c/o Janes All the Worlds Aircraft 1954 | Cali Pinto c/o Francis Neri albums |

Near-term economic benefit from additional air assets, therefore, would be found in maintenance contract opportunities. The influx of new aircraft — from supersonic jets to new transport and patrol aircraft — create numerous potential service contracts for qualified companies. Keeping what we buy in the air with as much involvement of local companies — providing licensed or OEM-certified services — as possible ensures operational readiness of these aircraft as well as providing economic benefit to the local aerospace industry.

The increased capabilities of these new aircraft come at a price. Not only in terms of capital outlay, but upkeep. Modern electronics need levels of attention that older, less-sophisticated and less capable, systems could potentially get by without. This is particularly true of cutting-edge modular avionics systems that can’t simply be jury-rigged into operation when they become nonoperational.

Consider the following aeronautical developments and a simplified sampling of their corresponding support burden would be candidates for logistical agreements:

Business-as-usual, part-by-part, piecemeal acquisitions — that would have the AFP issue bid invitations for each individual component, with all the attendant bureaucratic overhead and potential for delay-causing re-bids — would hamper operational readiness of these aircraft in ways that wouldn’t on older but less-capable, Vietnam War-era aircraft. An FA-50, for example, could be fully operational in all respects. But if its fly-by-wire computers are rendered non-operational by the lack of appropriate spares it will stay on the ground. A non-operational “hangar queen” or non-mission-capable asset is a poor return on investment for the people’s money.

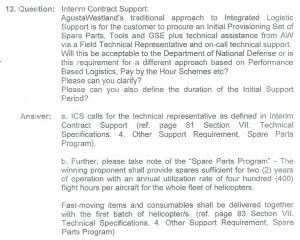

While the AFP modernization law requires that each acquisition include provision for an Integrated Logistics Package (ILP) from the manufacturer, such packages are finite. The following excerpt from a Supplemental Bid Bulletin from the PAF’s Attack Helicopter project, which eventually acquired the AgustaWestland AW109, presents an example of the extent of spares that are included in acquisitions. This document lays out how much time the AFP typically has to establish a more sustained spares acquisition scheme after a weapon system arrives.

|

For the long-term, in-country capability for supporting these aircraft must be developed. If done with the nation’s interests in mind, this need could be filled by Philippine companies — in partnership with foreign manufacturers of the equipment — that would provide logistical support arrangements to ensure local availability of manufacture-approved parts as well as in-country maintenance and repair capabilities. Companies offering these services would be contracted to provide ready availability of critical components at pre-negotiated prices based on forecasts of the need for such parts (e.g., based on maintenance schedules, Mean-Time-Between-Failure (MTBF) data, statistical trends, etc.) as well as foreign currency fluctuation tolerances.

This would reduce the delays created by having to source replacement components overseas after having exhausted the AFP’s own internal inventory — assuming budgetary provisions permit the build-up of such an inventory as opposed to a Just-In-Time (JIT) parts requisition scheme. The red-tape generated by government procurement processes currently do not facilitate JIT acquisitions.

Note: The complexities of balancing quantities between in-house AFP component stocks with components sourced through these logistical arrangements are beyond the goals of this article and would require direct access to proprietary maintenance data. Attention must also be given to the tariffs that such companies would face for importing and then storing these components. The potential for leveraging the industrial park status of the Government Arsenal compound in Limay Bataan, to address these tariffs, would need to be investigated. See further below for details.

A foreign example of a commercial entity providing logistical support for a military organization would be Quantas Defense Services — previously a wholly owned subsidiary of Quantas Airlines but was sold to Northrop Grumman in 2013. This company provided support for the Royal Australian Air Fore’s A330 multi-role tanker transport fleet, operational logistics services for the Australian government’s VIP aircraft, and engine overhaul services for the Lockheed Martin Orion P-3 and BAE Systems Hawk lead-in fighter trainer. It was recently given a contract to refurbish C-130s of the Indonesian Air Force.

Broadly speaking, this equipment-support capability is referred to as: Maintain, Repair, & Overhaul (MRO). The Philippines is no stranger to aeronautical MRO — particularly the commercial MRO that is at the heart of this article. The Philippine Aerospace Development Corporation, a Government Owned & Controlled Corporation (GOCC), was established in 1973 with the following charter:

. . . the government’s arm for the development of the Philippine Aviation Industry. The driving motives for its establishment are self-reliance, national security and technology transfer.

|

PADC currently provides MRO services for the following:

| Services | Description | |

| Airframe | Inspection, repair and alteration of:

|

|

| Engines | Lycoming and Continental piston engines up to four hundred (400) HP rating

As the Allison Authorized Maintenance and Overhaul Center (AMOC)in the Philippines, PADC undertook theForeign Military Sales (FMS) program on the overhaul of the Allison 250-C30 engines of the Sikorsky helicopters and the Allison 250-B17 engines of the Nomads |

|

| Propellers | Repair and overhaul facilities for:

|

|

| Landing gear | Functional Test, Repair and Overhaul of landings gears for:

|

As shown by the list above — which was taken from the PADC Website — these capabilities remain limited to the types of aircraft that were in service at the time of this GOCC’s inception. Whereas private MRO companies, such as Lufthansa Technik Philippines — a joint venture between MacroAsia Corporation and Lufthansa Technik AG — benefit from foreign capital and know-how and cater to larger and more sophisticated aircraft, the PADC’s service offerings are comparatively stunted.

In its current form, the PADC is ill-suited to provide MRO services for the dozens of aircraft that are coming for the AFP. Closing the gap between current capabilities with what our new warplanes require will require a systemic evaluation of why the PADC atrophied in the first place. Assuming the PADC can be recapitalized and modernized, if not replaced with an equivalent but optimized organization, such an entity would be the perfect platform for Public-Private Partnership ventures that would not only satisfy the needs of the AFP, but also compete in the global MRO market.

For this to work, however, critical mass involving the following considerations must be reached:

- Funding

- Opportunity

- Know-how

The funding is there, care of the various funding instruments that have been developed over the years to justify and enable defense spending. These include procedures for proper access of the AFP Modernization Trust Fund, legal basis for private contributions to that fund (c/o Section 6, sub-paragraph “i” of Republic Act 10349), to the implementing guidelines for Multi-Year Obligating Authority (MYOA) for DND acquisitions that exceed the annual budgetary allocation of the national budget.

“Opportunity” is a function of a multitude of factors but recapitalization of the air arms of the various services already create a baseline upon which to build. The new aircraft being acquired create this opportunity.

On the matter of “Know-How”, a shining example of advancements in locally available skills came to the fore in 2013, when the Philippine Air Force reached a major capability milestone careof the 410th Maintenance Wing when it completed Programmed Depot Maintenance (PDM) for C-130 #3633. A PDM is the aircraft equivalent to a major overhaul for a car, and in the US Air Force is done every 48 to 64 months. The 410th MW not only identified sources for the necessary parts — albeit piecemeal because of the lack of logistics arrangements — it also mustered the necessary technical expertise to complete the PDM in-house.

|

Previously, the PAF had never undertaken its own PDM of its complicated Hercules transports. The event was a testament to the PAF’s efforts to improve the technical proficiency of its personnel. While the need to retain these capabilities within the Philippine Air Force is important, the potential for leveraging these skills and lessons-learned in this effort to compete in the global Maintenance, Repair, Overhaul (MRO) market for military aircraft — as a properly OEM-certified maintenance facility — should not be ignored.

It is worth noting that the Malaysian Air Force unit responsible for similar functions was eventually privatized as a joint-venture with Lockheed Martin and became Airod Malaysia, which continues to provide support for the Malaysian Air Force. In 1997, Airod provided PDM services fo PAF C-130 #4593.

A conscious effort to maintain PAF equipment using a combination of in-house capabilities and domestic MRO companies as part of a self-reliance program would boost the MRO industry to the benefit of the Philippine labor force. Not only would this strengthen the local aerospace industry, it would also reduce the outflow of foreign currency. The experience, and resulting capital build up generated by a maintain-locally policy could very well give impetus to more ambitious aerospace manufacturing ventures. Provided, of course, that the Philippines were properly organized for such a transition. (See further down for how to organize for this shift).

Keeping aircraft in the air will mean profit for someone. Why not make sure that that “someone” is the Filipino people?

Economic windfall from maritime acquisitions

The Philippine Navy is in the midst of the largest post-Martial Law build up in its history. Plans to recapitalize the service have been in existence since the 1995 modernization program. The Navy reminded the public of this effort when it published it’s “desired force mix” in 2012 providing specific force-strength requirements for various types of vessels. The service refreshed this notice again three years later when it published he following infographic on the Philippine Navy website.

|

The individual components of the PN’s modernization plan are the most expensive members of the AFP modernization effort. Consider the following projects on the list at the start of this article:

| Project | Authorized Budget for Contract | Quantity | ||

| Strategic Sealift Vessel Acquisition Project | P4,000,000,000.00 | 2 | ||

| Frigate Acquisition Project | P18,000,000,000.00 | 2 |

With an annual modernization budget of only P5B per year, many of the navy’s projects would not even be possible without the Multi-Year Obligating Authority drafted in 2010. The SSV project budget alone is larger than the appropriations for either the Department of Science and Technology or Department of Trade and Industry. The sheer amount of monetary resources that these projects require make them prime candidates for the budget slasher’s axe.

From a purely defense-centric perspective, the need for these acquisitions is undeniable. These vessels resolve long-standing capability gaps that prevent the Philippine Navy from operating in a modern maritime threat environment. It is the only navy in Southeast Asia without missile capable boats, and until its frigates arrive is the only maritime force with no response to a submarine threat.

But aside from emphasizing that these assets are par-for-the-course for 21st century maritime security, defense planners could also emphasize the economic benefits of continuing the maritime build-up — regardless if the vessels are actually built locally or imported.

The obvious direct benefit to the economy would be to build ships on the modernization list locally. With the navy fresh on the heels of two relatively recent self-reliant shipbuilding programs, there is ample evidence to prove that Philippine shipyards are ready to answer the call to build military vessels. These two projects are the Multi-Purpose Assault Craft (MPAC) manufactured by Propmech in Subic Bay, and the largest domestically built military vessel in AFP history: the BRP Tagbanua Landing Craft Utility (LCU) which was manufactured in Philippine Iron Construction & Marine Works (PICMW) in Jasaan, Misamis Oriental. Both appear below.

|

|

|

| BRP Tagbanua (PN photo) | Multi-Purpose Assault Craft (DND photo) |

It’s worth noting that the following components of the Sail Plan are comparable to the MPAC and LCU projects, in terms of vessel size, as well as technical and construction complexity, and would therefore be low-hanging-fruit for an indigenous shipbuilding program:

- Fast Attack Craft (42 units)

- Landing Craft Utility

Beyond these types of vessels, however, the Philippine Navy has thus far sought foreign assistance. The first SSV, the BRP Tarlac (LD-601) was built in PT PAL in Indonesia and the second SSV is being constructed at the same yard. For the Frigate project, a South Korean shipyard is currently undergoing Post Qualification evaluation for this two-ship acquisition.

There is good reason for this. While there are indeed shipyards in the Philippines with significant slipways and are capable of constructing as many as five massive container ships simultaneously, these large yards are actually foreign-owned and are focused primarily on building ships for their foreign owner’s order books. The lack of participation of local shipyards in the bid invitations for the SSV and Frigate projects strongly implies that the local industry acknowledges this limitation.

Filipino controlled local shipyards face a number of challenges that need resolution. These range from the cost of electricity, supply chain issues (e.g., lack of domestic steel sources, etc.), to skills-deficits. On top of these industry challenges, there is also the matter of restricted access to key sub-systems that make up a modern warship. Foreign-manufactured sensors, advanced weapon systems, and similarly sensitive equipment are not available for export (e.g., ITAR) to non-state buyers. So local shipbuilders would not be able acquire these sub-systems themselves.

Therefore, for the near-term, we will need to resort to foreign sourcing for vessels that exceed our manufacturing capability or access to technology. This gives the AFP the best opportunity to achieve its modernization goals within a reasonable timeframe. The operative word being “near-term”.

Philippine Navy Sail Plan 2020 requires multiple instances of each ship. Therefore even if the initial orders for ships go to foreign shipyards, subsequent order need not be. A prime example of this mode of acquisition is Indonesia, and actually involves the Strategic Support Vessel (SSV).

The recently delivered Tarlac class SSV is based on the based on the Indonesian Navy’s “improved Makassar” class Landing Ship Dock (LPD). This ship, in turn, was derived from a design by Daesun Shipbuilding & Engineering of South Korea which built the first two ships of the class for Indonesia in South Korean shipyards. PT PAL, the Indonesian shipyard which built the BRP Tarlac and is currently building its sister ship, acquired design rights to the Makassar class LPD from South Korea, and is now offering the vessels for export. Whether or not South Korea continues to receive compensation for future sales of their design is unclear.

The potential benefits for the Philippine economy are too great to ignore. With careful planning, industrial incentives, licensing agreements with foreign partners — comparable to what Indonesia negotiated with South Korea — and synergy with the local shipbuilding industry, the remaining items in the Sail Plan could function as a catalyst for the shipbuilding industry.

Basis in law

Incremental efforts, from the Ramos to the Arroyo administration have created a legal framework that actually reduces the legislative ground work that the Duterte administration needs to perform to implement the proposals listed above. The unprecedented volume of purchases completed or initiated during the Aquino administration is — in truth — a net effect of the efforts that have come before. There is, therefore, no legal or procedural impediment to continuation of the current trend.

The AFP modernization law explicitly favors locally-manufactured defense articles:

Sec. 10. Self-Reliant Defense Posture Program. — (a) In implementing the modernization program, the AFP shall, as far as practicable, give preference to Filipino contractors and suppliers or to foreign contractors or suppliers willing and able to locate a substantial portion of, if not the entire, production process of the term(s) involved, within the Philippines.

(b) In order to reduce foreign exchange outflow, generate local employment opportunities and enhance technology transfer to the Philippines, the Secretary of National Defense shall, as far as feasible, incorporate in each contract/agreement special foreign exchange reduction schemes such as countertrade, in country manufacture, co-production , or other innovative arrangements or combinations thereof.

(c) The AFP likewise ensure that in negotiating all applicable contracts or agreements, provisions are incorporated respecting the transfer to the AFP of the principal technology involved as well as the training of AFP personnel to operate and maintain such equipment or technology.

The “spirit of the law” favors a Filipino-First procurement scheme.

As things currently stand, all pending acquisitions are required to have a local Philippine partner. A requirement enshrined in the Carlos Garcia-era Republic Act 5183 prohibits the Philippine government from sourcing items from companies that aren’t majority Filipino owned. This means that any foreign vendor seeking to sell its wares to the AFP needs to establish arrangements with Philippine business entities, which will then be responsible for representing the vendor in public biddings and similar engagements.

The legal framework for domestic windfall from the billions of pesos slated for defense expenditure for already-ongoing projects is already in-place. All that a prospective Secretary of National Defense, Chief of Staff AFP, or defense adviser would need do is to highlight this prospectively unaware policy makers within a Duterte cabinet.

Putting the plan in action

The law calls for technology transfers as part of as many acquisitions as possible. But creating the entities that would actually absorb that technology are simply non-existent. The Philippines’ failure to implement a far-reaching industrialization program has been a persistent stumbling block to the local defense industry. There are few, if any, companies that could oversee a turn-key transfer of defense technology.

While RA 5183 has been in existence for over half a decade, thus far it’s principal achievement as been the institutionalization of the “middle-man” industry: companies that simply peddle access to the corridors of power rather than actually promote the local defense industry.

Three key enablers must exist for this self-reliance based modernization program to take root:

- A coordinating body that can marshall government and industry resources for the identification and evaluation of technologies that would be candidates for technology transfer

- A manufacturing entity that would either serve as a catalyst for its sector or as proof of concept for local manufacture of defense articles

- A skills development agency that would ensure that existing, and prospective defense companies would have a pool of properly trained and educated workers from which it can draw its manpower requirements

Without these three pillars of self-reliance, any indigenous development program would be doomed to failure. From the 1950s to the today, the history of the indigenous defense industry is littered with failed ventures and prototypes that went nowhere mainly because of the lack of this three-legged framework.

All three enablers can, theoretically, be either based on existing agencies or be entities that would have to be created. The following sections presents one way such enablers could be setup.

Coordinating body: A PH DARPA

The Philippines needs an equivalent to South Korea’s Defense Acquisition Program Administration (DAPA), Singapore’s Defense Science and Technology Agency (DSTA), and the US’ Defense Advanced Research Projects Agency (DARPA). These organizations are drivers for defense technology innovation in their respective countries. For additional details about how a prospective Philippine DARPA would emulate the roles of these agencies in the Philippine setting, see the following article, which was endorsed for consideration within the DND-AFP decision structure in 2014: A Self-Reliant Posture (SRDP) Roadmap and a DARPA equivalent.

|

|

|

This coordinating body’s principal function would be to ensure that the DND-AFP is a “wise buyer”. One that knows what it needs to buy, clearly articulate its needs to prospective bidders, and is able to distinguish between a lemon and a diamond-in-the-rough, when selecting items to be acquired. It would also determine whether or not the country’s needs are best served by acquisition of specific technologies and licenses for local manufacture, or if an outright purchase of equipment from foreign vendors is more appropriate. For an older discussion about considerations for local manufacture, see here.

Once the prospective PH DARPA determines that technology or license acquisition is a practical option, selection of a method for ingesting that technology or license becomes the next SRDP imperative.

When the items to be acquired are either technology, or licenses to produce equipment locally, then it would be the prospective PH DARPA’s role to facilitate absorption of that acquisition either by:

- Using a government manufacturing entity such as the Government Arsenal

- An existing commercial enterprise that would have to be selected through a competitive evaluation process to ensure the best qualified recipient, and to avoid allegations of impropriety

- A completely new entity, either in the form of a Government Owned and Controlled Corporation, or a Public-Private Partnership

Integral to that function would be evaluation of existing manufacturing relationships, assessing their benefits to the government — both for economics and security of access to materiel — and implementing a plan to move forward.

Manufacturing entity: Government Arsenal

Earlier in this article, the Philippine Aerospace Development Corporation was presented as an imperfect potential government interface to Public-Private Partnerships that would satisfy the needs identified in this article. There is, however, another government entity — under the Department of National Defense — that is currently operational and setting production records for items under its charter — a testament to the quality of its management, as well as the maturity of the organization: The Government Arsenal.

Although currently focused on munitions and small arms production, the Government Arsenal remains a logical starting point for any search for a model for domestic defense manufacture. It is a manufacturing entity that the government itself owns, and has a proven track record for marshaling engineering and manufacturing prowess in support of national defense. It has reached out to civilian agencies such as the Metals Industry Research and Development Center of the Department of Science & Technology, as well as private manufacturing concerns as part of its Research & Development efforts, making it a hub for defense technology knowledge.

By regulation, it is the primary source of war materiel for the AFP, PNP, and other uniformed services which can’t source ammunition externally unless the arsenal is not able to satisfy the need. As per Executive Order 303, Series of 2004:

SECTION 1. Sourcing the Government Munitions Requirements. The AFP, PNP, and other government agencies are hereby directed to source their small arms ammunition and such other munitions requirements as may be available from the Government Arsenal;

This is a significant, albeit controversial, advantage that ensures any government investment in the institution will be put to use for its benefit.

In addition breaking ammunition production records that were set in the 70s, the revitalized Government Arsenal has also embarked on a modernization program designed to assure the quality of its products, enhance accountability, and improve production efficiency. The following photos summarizing recent modernization gains were obtained from the Arsenal’s FB page.

The Philippine Economic Zone Authority recently approved its application to designate its sprawling complex in Lamao, Limay, Bataan as an industrial park. Once formally approved by the Office of the President, this status would put the arsenal in an interesting position to function as an “incubator” for defense-related enterprises.

|

Working under the oversight of the prospective PH DARPA, and in cooperation with business development agencies such

- National Development Corporation

- Philippine Investment & Trade Corporation

- Public-Private Partnership Center of the Philippines

- Board of Investments

Government Arsenal facilities and management expertise could be brought to bear to either establish new ventures, or form partnerships with existing enterprises, to fulfill the logistical and/or manufacturing needs created by the influx of new equipment or the new equipment requirements laid out by the AFP modernization program.

Circling back to the proposals put forth earlier in the article, one candidate use for the GA’s industrial estate would be as host for affordable (if not outright free) manufacturing and office spaces embryonic defense companies, as well as secure storage facilities for goods that will eventually be sold to the AFP as part of logistical agreements. With the GA facility being a military base in its own right — know officially as Camp Heneral Antonio Luna — it provides unparalleled security for defense-industry investment.

Exploration of the potential tariff and immigration status incentives that could be offered for operating within the Industrial Estate must also be explored, but are currently beyond the scope of this article.

Whether these new ventures will eventually partner with the GA or a re-capitalized PADC, or if they will be entirely new separate ventures that could simply benefit from the GA’s infrastructure, will ultimately depend upon the judgement of the prospective PH DARPA and its partner agencies.

Skills development agency: TESDA and the National Defense College of the Philippines

Defense industries require specific skills not normally found in the private sector. A chemist knowledgeable in the explosive yield of specific proportions of highly combustible chemical compounds, for example, won’t be readily found among the roster of graduates of conventional schools. Neither will skilled rifled gun barrel makers.

Integral to the Government Arsenal’s modernization efforts is skills development of its staff. For this reason, the Arsenal has established education linkages with various foreign governments and institutions to establish education linkages with with their centers for defense education. Arsenal personnel have been sent for advanced Turkey for ammunition quality control courses, to Czechoslovakia for barrel manufacturing training, and to Nevada in the United States for various armorer’s courses.

A revitalized Philippine defense industry will need similar access to skills development opportunities as its range of services improve. A defense industrial complex will need its own schools to produce manpower with the right know-how.

|

|

The Technical Education and Skills Development Authority (TESDA), would be a logical starting point for the creation of the manufacturing base for defense companies. Apprenticeship programs could, theoretically, be arranged with the various manufacturing offices of the Government Arsenal, Philippine Aerospace Development Corporation (PADC) and similar institutions.

For more sophisticated projects (e.g., avionics design and maintenance, guidance software design), the Philippines could presumably follow the lead of Singapore’s Temasek Defense Systems Institute, which offers post graduate degrees for a variety of fields (e.g., Master of Science (Defence Technology and Systems) and maintains linkages with similar institutions such as the Naval Post Graduate School in Monterey CA.

The AFP’s own institutions of learning would be obvious foundations upon which such a post graduate program could be built. Particularly the National Defense College of the Philippines (NDCP) which is already recognized as an institution of higher learning, and is adept at maintaining linkages with the civilian academia.

Summary

To fulfill its constitutional mandate to protect the integrity of Philippine territory, the Armed Forces of the Philippines must be equipped to fight 21st century conflicts. From 1995 — when the first modernization law was enacted — to the present day, progress of this modernization effort has been snail-paced. Only in the past six years have significant strides been made, in no small part due to the existential threat posed by the People’s Republic of China.

To sustain the gains of the defense buildup, particularly in a fiscal environment that favors domestic concerns and populist programs, the Department of National Defense must demonstrate that the billions of pesos spent on its acquisitions have a direct benefit to the Philippine economy. By implementing the provisions of the AFP Modernization Law that require technology transfers and domestic production, the AFP modernization program could be packaged as a investment in new income-generating industries rather than superfluous expenditure.

Support for the domestic arms industry, and the employment they generate, could very well be what ensures continuity of the modernization program in the Duterte administration.